In the fast-paced world of digital payments, financial institutions are embracing QR code technology to streamline operations and improve customer experiences. From mobile banking to QR code payments, these tools bring speed, security, and ease of use to everyday financial interactions.

Using QR codes helps banks, insurers, and fintech companies modernise their payment systems and strengthen trust with clients. Whether for money transfers, credit card verification, or insurance claims, a single scan of the QR code can securely complete complex financial transactions in seconds.

QR code payment systems offer contactless payment methods that make life easier for both businesses and consumers. Customers can scan the QR code to make digital payments, open bank accounts, or access insurance documents directly from their mobile devices.

The ease of use of dynamic QR codes eliminates manual entry errors and reduces wait times, creating a smoother, more reliable user experience.

👉 Learn more about Dynamic QR Codes for secure, flexible linking.

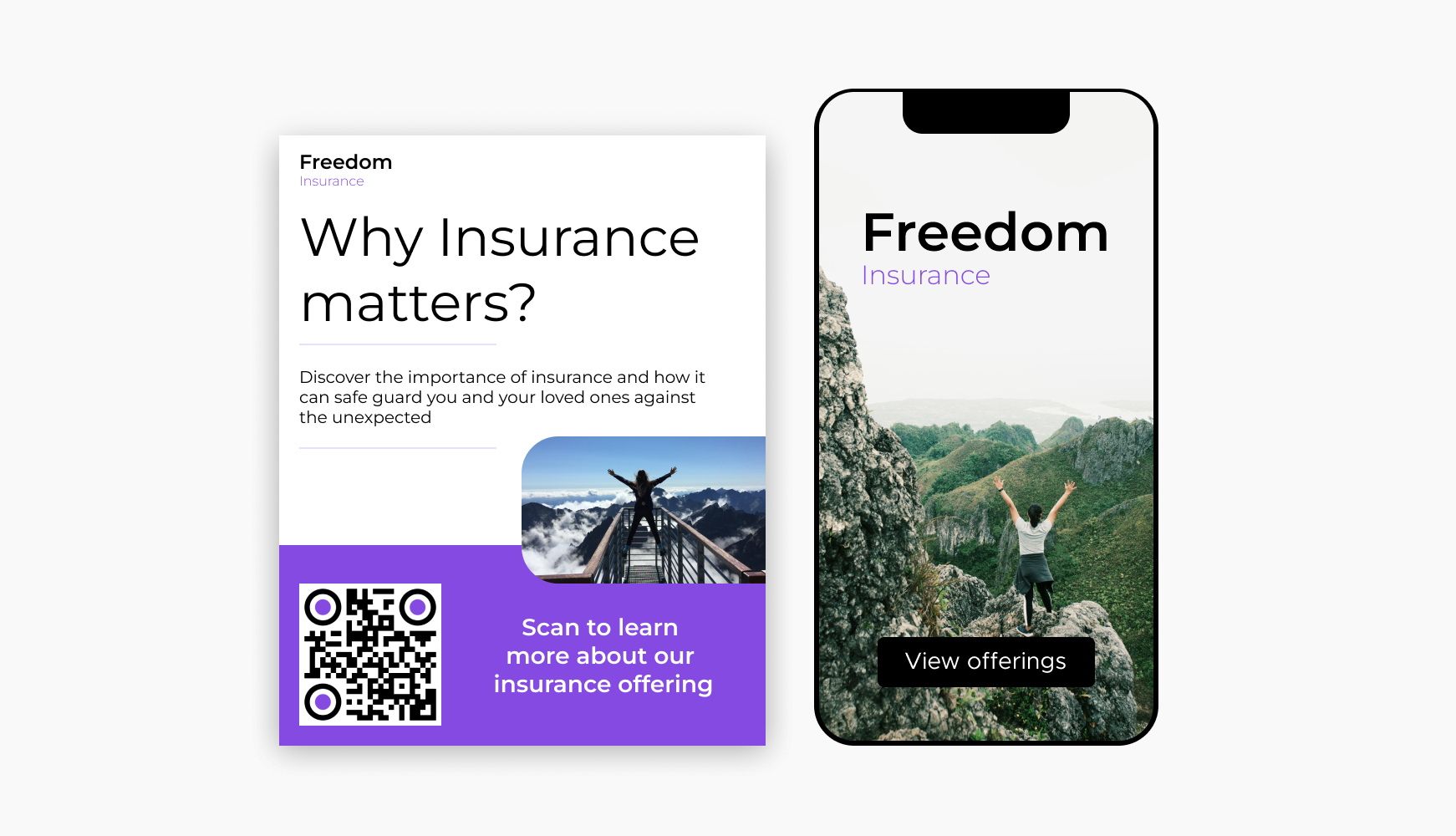

Bridge your offline and digital channels. Adding QR codes to print ads, brochures, and business cards connects your physical marketing to online resources, landing pages, and mobile apps. This hybrid approach drives higher engagement and app downloads.

👉 Try QR Codes for Marketing Campaigns to boost conversion rates.

Using QR codes reduces paperwork and automates form completion, cutting time and printing costs. A scan of the QR code can auto-populate customer details for applications, renewals, or policy updates — saving hours of manual work and reducing human error.

QR code payments ensure safe, encrypted financial transactions between customers and institutions. With dynamic QR codes, banks can track scans, locations, and engagement data to understand user behaviour and measure campaign performance.

👉 Discover QR Code Tracking and Analytics for data-driven insights.

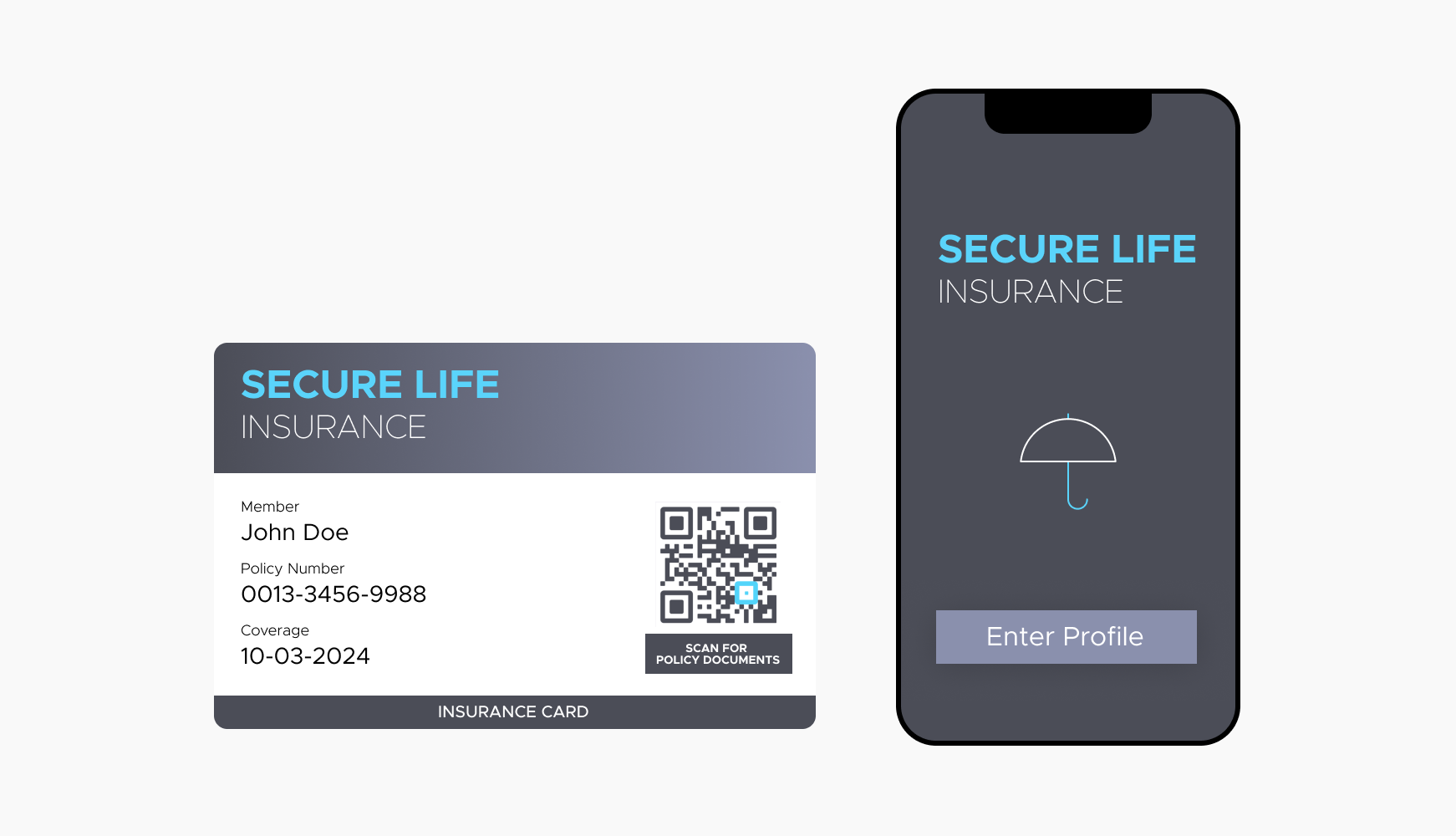

Add QR codes to insurance cards to simplify policy access. When customers scan the QR code, they can retrieve policy details, file claims, or get assistance instantly — improving efficiency and customer satisfaction.

Streamline loan processes with QR codes. Applicants can scan the QR code to start their online application or make secure premium payments using mobile banking or digital wallets.

Enhance networking by adding a custom QR code to your business card. When scanned, it saves contact information or opens your professional website — a smart, paperless solution that aligns with the digital payments ecosystem.

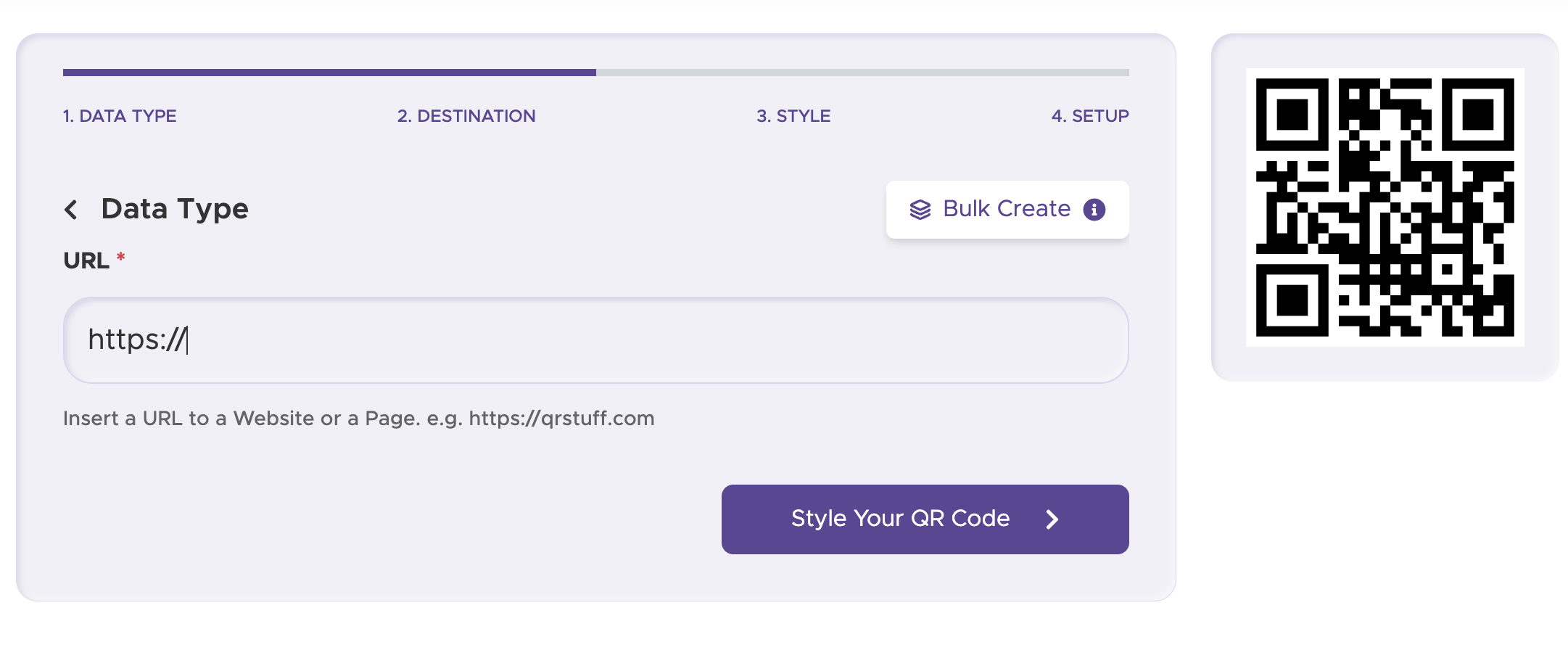

Follow this guide to create secure and effective QR codes for your financial institution.

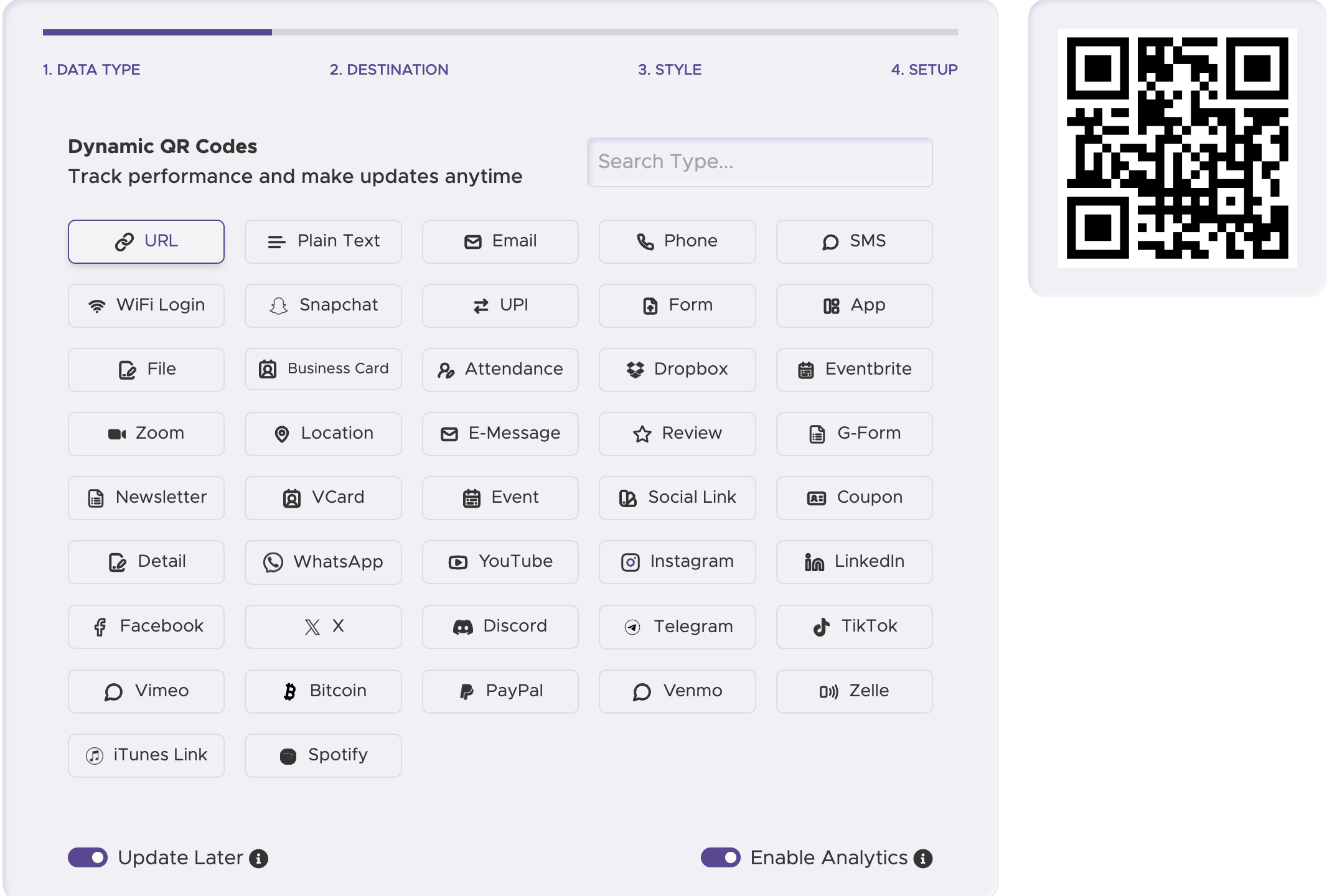

Use a trusted tool like QRStuff QR Code Generator. It offers dynamic QR codes, encryption, and full design customisation for the financial industry.

Choose the format that best fits your purpose:

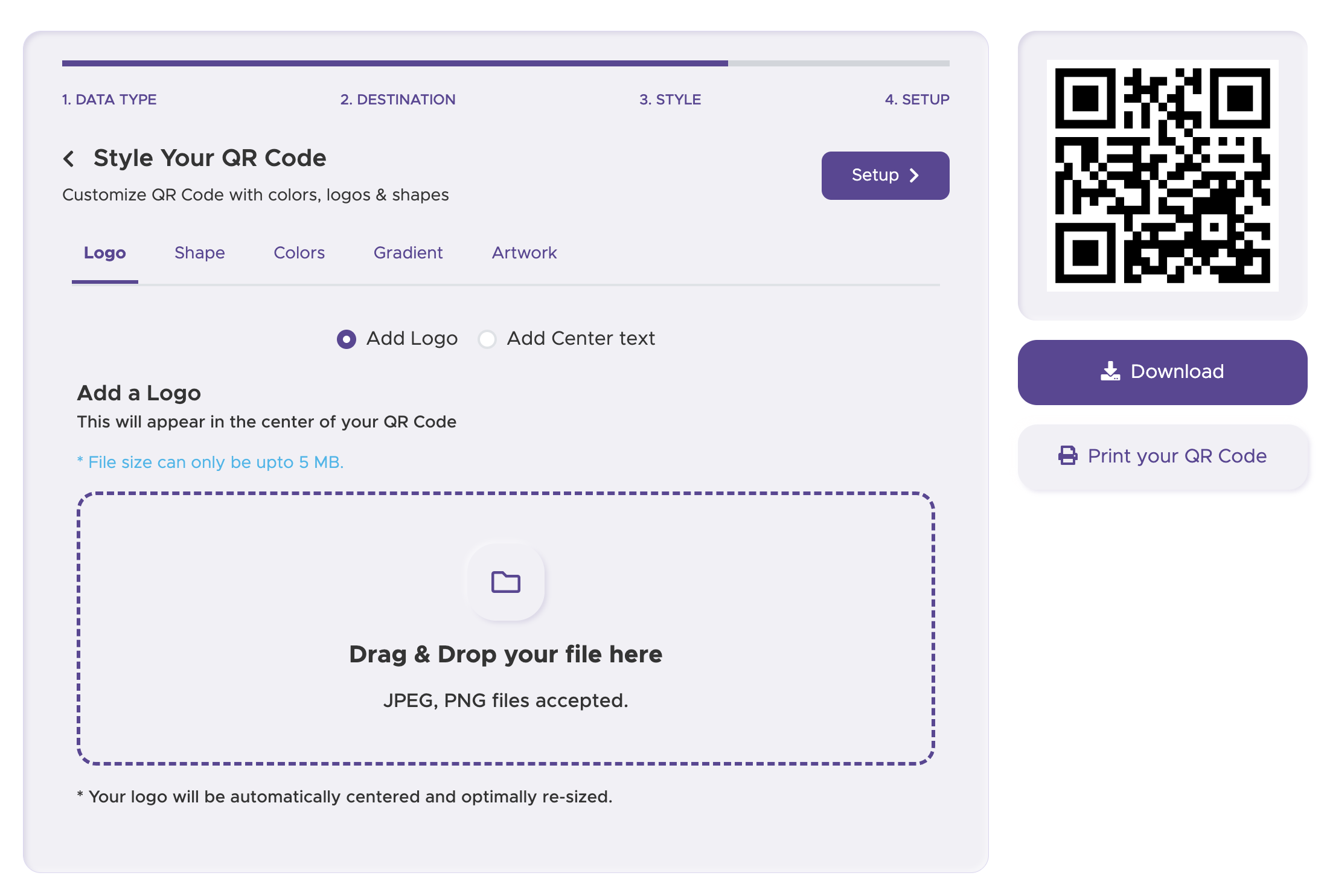

Make your code instantly recognisable. Add your company logo, apply brand colours, and go beyond black and white to build customer trust and improve scanning reliability.

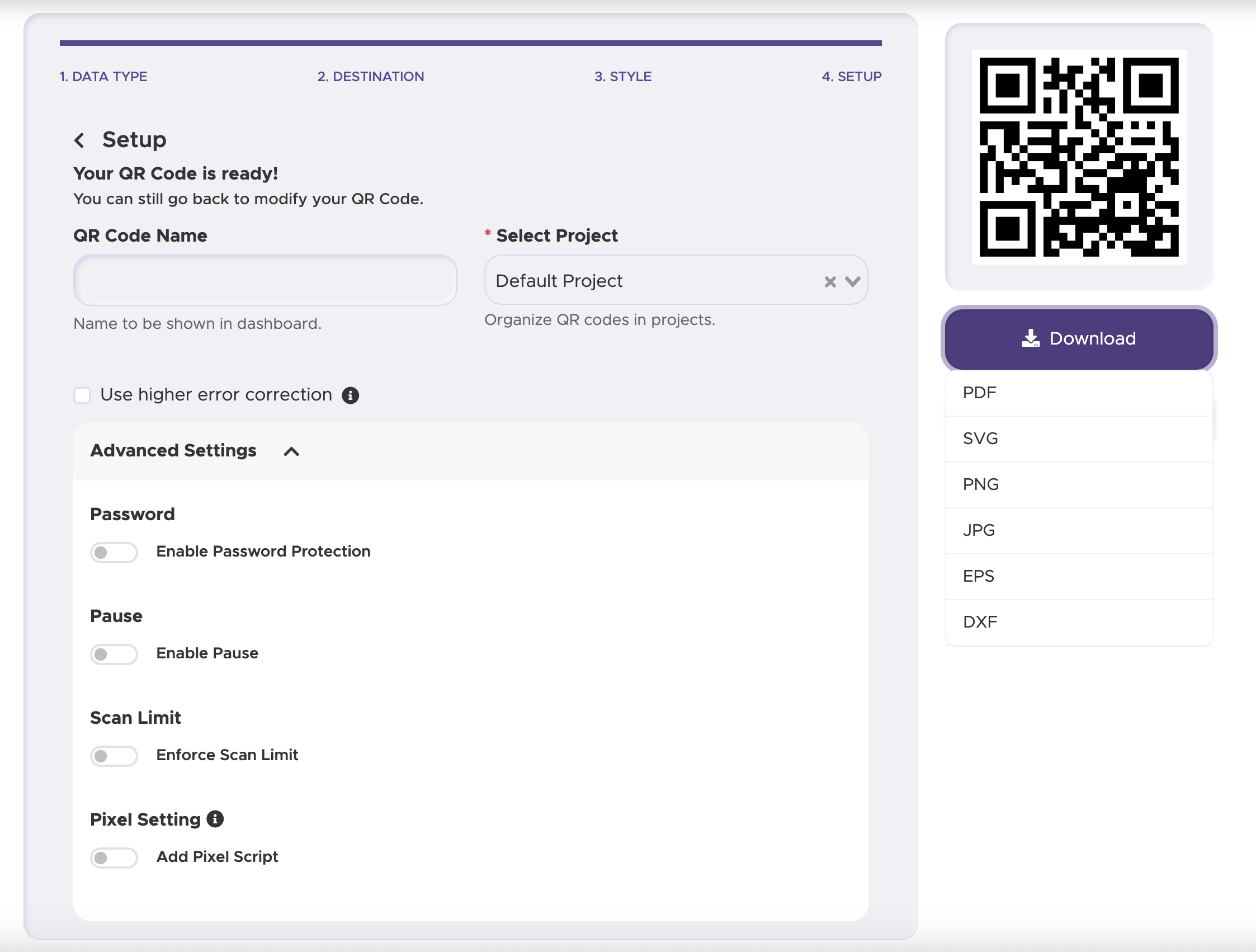

Download your finished, high-resolution QR codes for print and digital use. Always choose dynamic QR codes so you can update links and track payment system analytics without reprinting.

Guide users with short prompts like “Scan the QR Code to Pay” or “Scan for Policy Details.” Clear CTAs improve engagement and reduce confusion.

Ensure all QR code payments link to HTTPS-protected pages. Use reputable generators and secure APIs to safeguard bank accounts and credit card details.

Ensure your linked digital payment pages are mobile-friendly and compatible with Apple Pay and other digital wallets.

Simplify your financial transactions with secure, dynamic QR code payments.

Boost convenience, improve customer satisfaction, and modernise your entire payment system — all with one scan.

Start creating free QR codes today, or subscribe to unlock full design capabilities and advanced analytics

Yes, you can create QR codes for essential Finance & Insurance businesses needs like promotional offers, or customer feedback forms using our free QR code generator. However, customization options, such as branded QR codes or detailed scan analytics, require a subscription.

A subscription unlocks advanced features tailored to Finance & Insurance businesses, including dynamic QR codes that allow real-time updates, detailed scan analytics to track customer engagement, and customization tools to align QR codes with your branding. These features help improve efficiency, enhance customer experiences, and strengthen your business's overall impact. See the full list of features associated with each subscription here.

You can reach out to us at support@qrstuff.com for assistance. Free users receive email support with responses typically provided within 12–24 hours. Subscribers enjoy priority support via email, phone, or live chat for faster resolutions. To help us assist you efficiently, please include your account details, QR code ID, and a brief description of the issue when contacting support.