UPI is one of the most popular payment methods that businesses can implement. It's fast, efficient, and easy to use. However, not many people know how powerful QR codes are when it comes to UPI. In fact, they haven't even heard of it – let alone tried it out! But don't let that stop you from using this innovative technology in your business. Here's why QR codes and UPI go hand in hand - and how to use both for your advantage.

UPI stands for Unified Payments Interface, which was developed by the National Payments Corporation of India (NPCI). It's an open platform that allows you to send money to friends, family, or colleagues in minutes without having to worry about banks, checkbooks, or other middlemen.

The concept behind UPI is simple: instead of exchanging cash or cheques with people over the phone or via an agent, you can send money directly from your bank account through an app on your phone. The app will then deduct funds from your checking account, transfer them into another user's account and settle the transaction automatically.

As well as being more convenient than traditional methods of sending money, UPI also offers several security features, such as two-factor authentication and fraud detection software that help prevent the misuse of accounts.

The use of QR codes has become a regular feature of our lives. From using them to pay for things or even to get directions, the application of QR codes is increasing day by day. The reason why this has become so popular is that it allows us to do things like sharing our contact details with people we meet, as well as accessing information about products and services offered at stores.

QR codes have also become used in online payment systems such as UPI, which makes it easier for people to pay for goods and services online. This can be done through mobile phones, as well as computers and other devices that have access to the internet.

Ready to discover how QR codes can transform your business?

Start by creating your custom QR Code today

QR codes are an easy way to accept credit card payments online. They can be used by anyone with a smartphone and the right app, but they're most popular in eCommerce applications. The process is simple: a user captures a picture of the code using their phone's camera and then scans it using the app. Once they've done that, they can add the code to their website or mobile app.

Because QR codes can be read by smartphones, tablets, and even other devices like smartwatches, they're great for all kinds of products and services. You can use them in many different ways — as payment options, as links to relevant content on your website, or as part of a promotion campaign where people can earn points or rewards.

Reducing checkout time is one of the most important reasons why you should use QR codes in your checkout process.

QR codes allow customers to quickly and easily complete their payment with just a scan of their mobile device. This means that customers are able to quickly complete their purchase without having to type in any information or manually enter their credit card information.

A QR code is a great alternative because they're safer and easier to manage than traditional credit cards or cash. With a QR code-enabled mobile app, customers can confirm each purchase by scanning their phone screen instead of manually entering their information into an online order form or typing in sensitive information like their name or address on their keyboard.

UPI is a payment mode that has been adopted by a number of businesses across the country. The use of this platform is growing at an exponential rate and offers benefits to both consumers and businesses. Here are some of the key benefits of using UPI for business:

The UPI payment mechanism can be used for making payments in real-time, which is a key advantage of this payment method. This means that you can easily complete transactions without waiting for their confirmation or other actions.

The customer can also make payments through UPI without any complications and delays, as the transaction will be completed immediately after the request is sent.

Also, since it is an instant mode of payment, there are no chances of fraud or mistakes in the transaction process. In this way, you can ensure that your business remains protected from any kind of security issues due to fraudulent transactions or mistakes made by your customers.

UPI is a very secure mode of payment. It uses the same encryption technology as WhatsApp, Viber, and other messengers. This means that your private data is safe from hackers, and you can be sure that your transactions are secure.

Also, UPI is a good way to make sure that no one can tamper with your transactions. This helps in preventing fraud and keeping your business free from scams and fraudsters.

The fact that UPI is a mobile-first solution means it is possible to use it on a variety of devices. You don't have to worry about whether or not your users will have access to their wallets when they are out and about.

You can also use UPI with your eCommerce store so that customers can pay from their phones as well as from the checkout page. This means you don't have to worry about accepting payments at all different stages of the buying process—you only need to accept them once (at checkout).

UPI is a flexible and customizable payment processing platform that can be used to accept payments from various types of merchants, including online sellers, offline retailers, and others. The UPI API is versatile, allowing developers to create custom applications that integrate with UPI-enabled banks.

For example, if you are an online retailer, you can use the UPI API to set up recurring payments that automatically charge customers' bank accounts on a periodic basis (e.g., monthly). This provides a more convenient way for customers to pay for purchases without having to remember their credit card details each time they make a purchase.

UPI has many benefits for businesses. It is cheaper than other payment modes, especially if you have a large number of customers and transactions.

Here's how UPI can help you save money:

UPI QR Codes are a convenient way to make payments. They're easy to create, they're quick and they can be shared on social media. However, you still need to use them properly.

Here are some tips for creating UPI QR codes for payment:

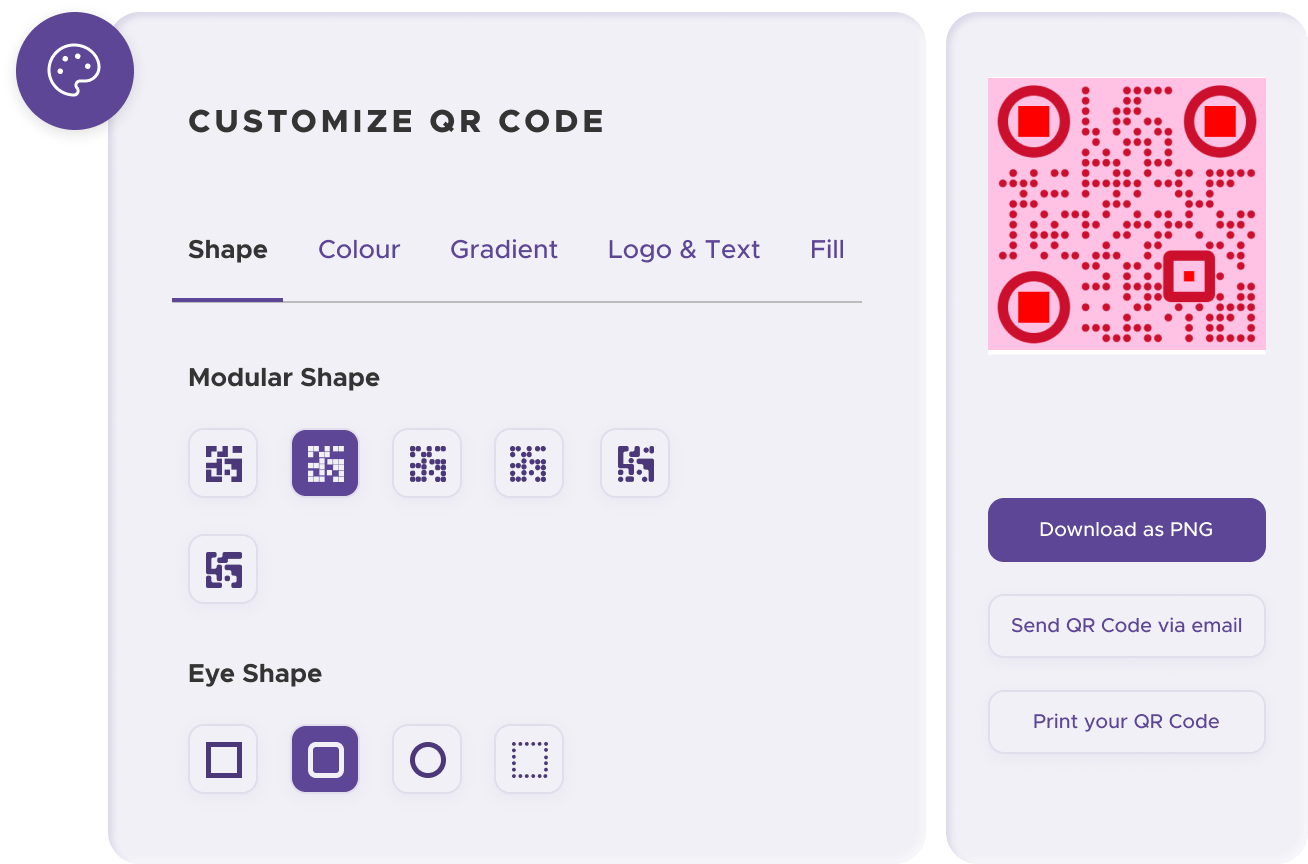

Image quality is very important in a QR code. The reason is that it will have a direct impact on the readability of your code. The image quality affects the size, contrast, and resolution of the code. It should be clear without any overlapping of lines and edges, which are all considered significant factors for reading an image with high precision.

The minimum width for a QR code is 1 inch (2.5 cm). Anything smaller will not be readable by most smartphones and can lead to misleading information if scanned.

The maximum size for a QR code is 30x60 pixels, and the recommended size is 20x30 pixels. This is larger than most credit card logos, which usually have an 8x10 pixel logo.

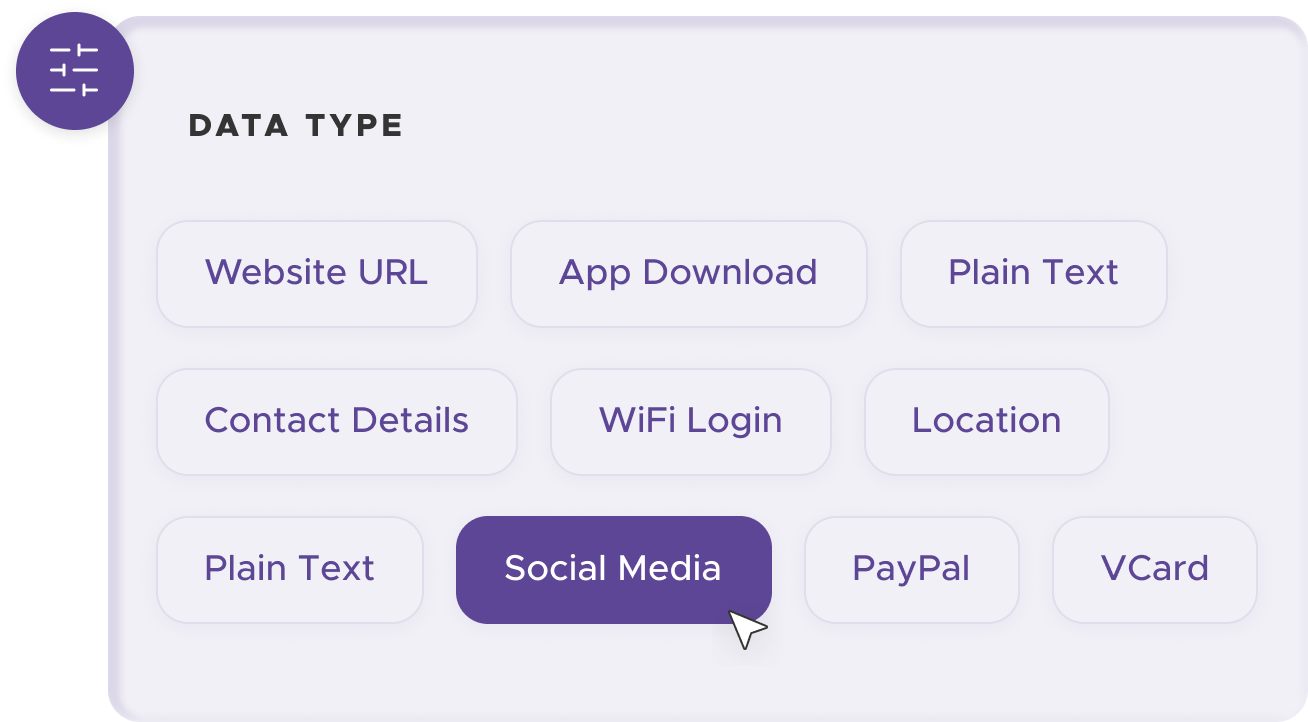

Select a reliable QR code generator like QRStuff, which offers a range of features to create dynamic and customizable QR codes suited for your business needs.

Ready to discover how QR codes can transform your business?

Start by creating your custom QR Code today

In the QRStuff generator, choose the specific "UPI" type. It enables customers to scan and pay instantly through Google Pay, PhonePe, Paytm, BHIM, or any UPI app.

Add customization to your QR code, such as your server's logo, colors, or other branding elements, to make it visually appealing and recognizable.

Before distributing your QR code, test it with multiple devices to ensure it directs to the intended place.

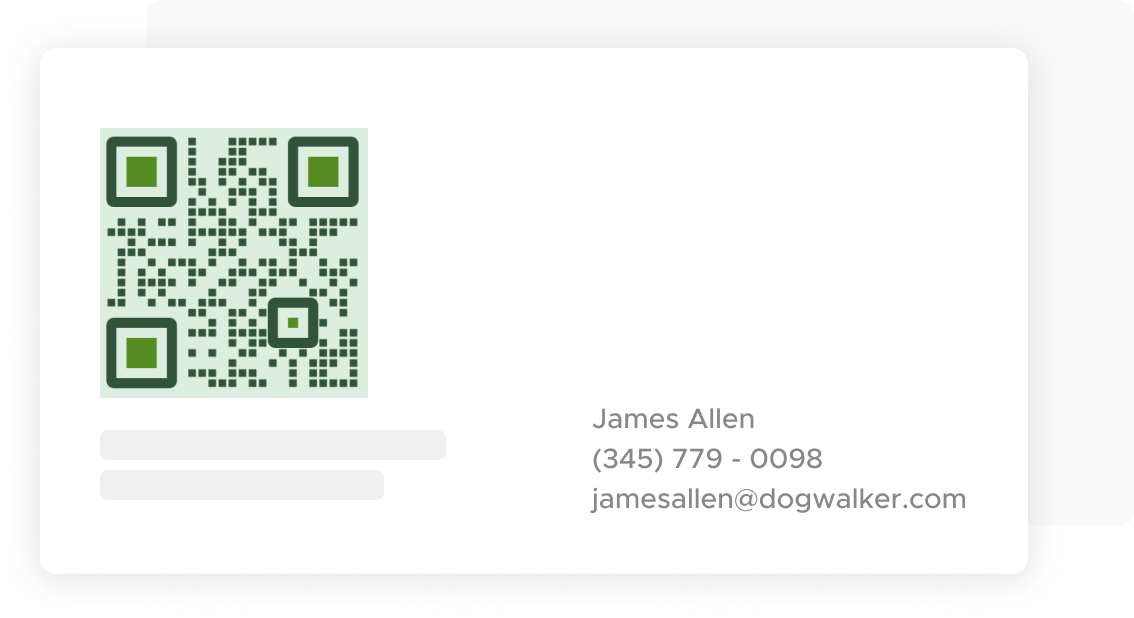

Print your QR code on various materials, such as business cards, posters, flyers, or merchandise, to make it easily accessible to your target audience.

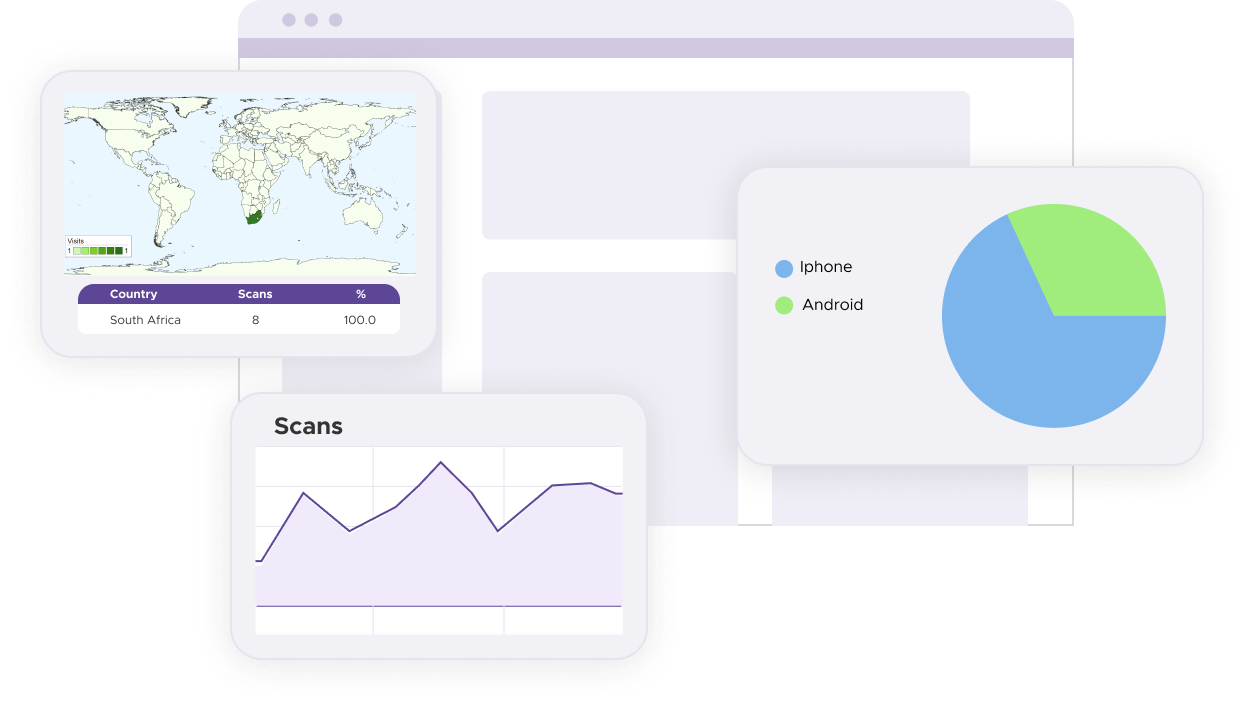

Use QRStuff’s dashboard to track the performance of your QR codes. Collect feedback and measure the success of each code, allowing you to optimize their use and improve customer engagement.

For some basic QR code needs, you can use our free generator. However, certain advanced features, like creating UPI QR codes or embedding dynamic content, require a subscription.

A subscription unlocks advanced features tailored to UPI, including dynamic QR codes that allow real-time updates, detailed scan analytics to track customer engagement, and customization tools to align QR codes with your branding. These features help improve efficiency, enhance customer experiences, and strengthen your business's overall impact. See the full list of features associated with each subscription here.

You can reach out to us at support@qrstuff.com for assistance. Free users receive email support with responses typically provided within 12–24 hours. Subscribers enjoy priority support via email, phone, or live chat for faster resolutions. To help us assist you efficiently, please include your account details, QR code ID, and a brief description of the issue when contacting support.